Turkish Tax System

State’s Taxation Authority

The taxation authority of the state, which in its essence constitutes a limitation on the right to property, also interferes with the rights and freedoms of individuals and derives its source from the Sovereign Authority; must be used in accordance with the constitutional principles of generality, legality, equality, taxation aimed at meeting public expenditures, taxation according to the ability to pay and the principle of proportionality, fair and balanced distribution of the tax burden as it is mentioned in Article 73 of Turkish Constitution

Turkish Constitution Article 73:

Duty to Pay Taxes

“Everyone is under obligation to pay taxes according to his financial resources, in order to meet public expenditure.

An equitable and balanced distribution of the tax burden is the social objective of fiscal policy.

Taxes, fees, duties, and other such financial obligations shall be imposed, amended, or revoked by law.

The President of the Republic may be empowered to amend the percentages of exemption, exceptions and reductions in taxes, fees, duties and other such financial obligations, within the minimum and maximum limits prescribed by law.”

(*) The duty to participate in the tax burden is not only compulsory for Turkish citizens, but also for everyone, including foreigners engaged in economic activity in Turkey.

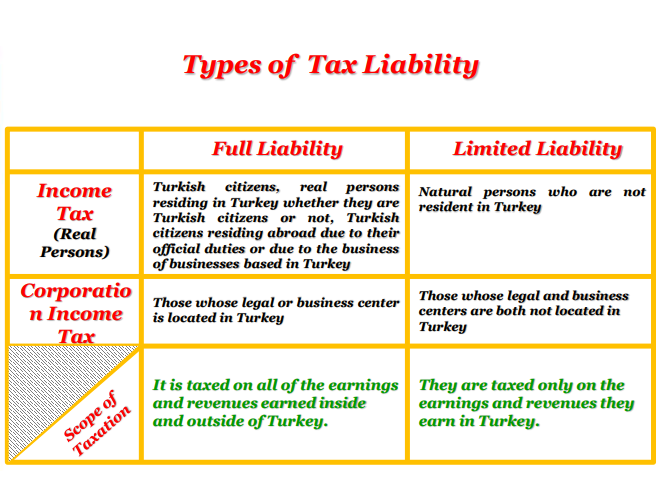

Types of Tax Liability

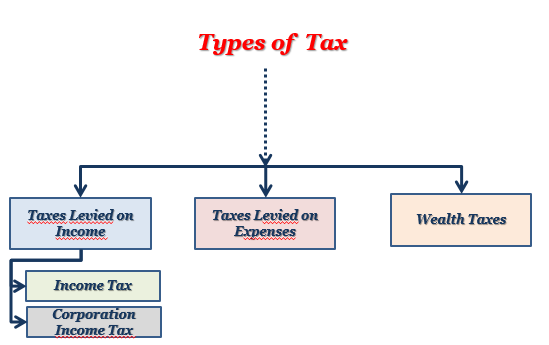

Tax Levied on Income

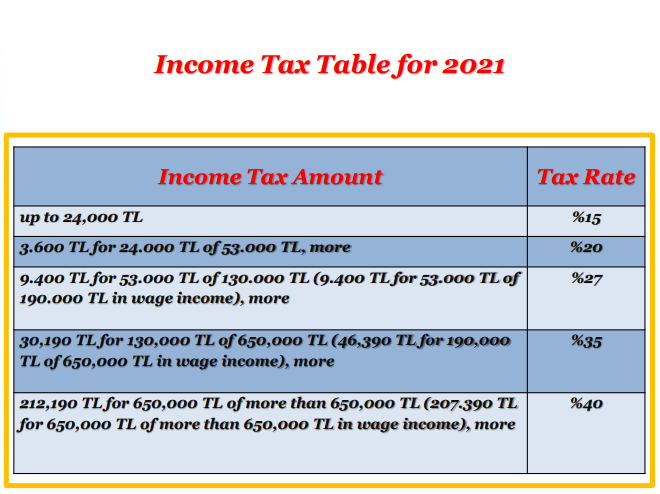

Income Tax Law income is defined as “the net amount of earnings and revenues earned by a real person in a calendar year” and deals with taxable income elements in seven categories (commercial income, agricultural income, wages, self-employment income, real estate capital income, securities. capital income and other income and income). Income tax is the taxes levied at an increasing rate (15%-40%) on these incomes of real persons.

Corporation Income Tax

These are taxes levied at the rate of 20% on the corporate earnings of capital companies, cooperatives, economic public institutions, associations or foundations and business partnerships.

Taxes Levied on Expenses

Value added tax, excise tax, banking and insurance transactions tax, special communication tax, gambling tax, customs duty, stamp duty and municipal taxes

Wealth Taxes

Wealth taxes consist of Motor Vehicles Tax, Real Estate Tax, Inheritance and Gift Tax.

Legal center according to the Corporate Tax Law: It is the center indicated in the establishment laws, presidential decrees, bylaws, main statutes or contracts of taxable institutions. Business center, on the other hand, is the center where transactions are actually collected and managed in terms of business.

Tax Privileges Provided to Limited Taxpayers

(GVK. article. 7/1) Export Exemption (In terms of income tax)

Non-resident limited liability companies are exempt from Income Tax if they export the goods they purchased or manufactured from Turkey for export without selling them in Turkey.

(KVK art. 3/3/a) Export Exemption In terms of corperation tax

If institutions that do not have a legal and actual business center in Turkey export the goods that they have purchased or manufactured in Turkey for export without selling them in Turkey, Corporate Tax will not be paid on the profits arising from this transaction. The purpose of selling in Turkey is that the buyer or seller, or both, are in Turkey, or the sales contract is concluded in Turkey.

(*) Fully liable persons cannot benefit from this exemption, which aims to encourage exports and thereby increase foreign currency inflows into the country.

Expenses Deducted from Income Tax

According to Article 40 of the Income Tax Law

General expenses incurred for obtaining and maintaining commercial income,

Subsistence and lodging expenses, treatment and medicine expenses, insurance premiums and retirement dues and clothing expenses as fixtures,

Losses, damages and indemnities paid pursuant to a contract, court order or legal order, provided that they are related to the work,

Travel and residence expenses,

Expenses of vehicles acquired through leasing or included in the business and used in the business,

Taxes, duties and charges in kind such as building, land, expense, consumption, stamp, municipal taxes, fees and records,

Depreciations allocated according to the provisions of the Tax Procedure Law,

Dues paid by employers to unions,

Contributions paid by employers to the private pension system on behalf of wage earners,

The cost of food, cleaning, clothing and fuel donated to associations and foundations engaged in food banking activities with the aim of helping the poor, within the framework of the procedures and principles determined by the Ministry of Treasury and Finance,

Amounts actually paid to beneficiaries of on-the-job training programs organized by the Turkish Employment Agency by the employers running the program.

Income Tax Law Article 88

Losses

According to Article 88 of the Income Tax Law, losses incurred due to economic activities carried out in the country and abroad are deducted from the income of the following years.

According to Article 89 of the Income Tax Law

50% of the premiums paid to the life insurance of the taxpayer’s person, spouse and young children, and personal insurance premiums such as death, accident, illness, health, disability, maternity, birth and collection

Education and health expenditures for the taxpayer himself, his wife and young children

Disability discount in the amount determined according to the working power loss rate

Up to 5% of the total of donations and aids made to public institutions, local administrations, foundations and associations working for public benefit, up to 5% of that year’s income

Expenditures made for the construction of schools, health facilities, student dormitories and kindergartens, orphanages, nursing homes and care and rehabilitation centers, places of worship and non-formal religious education facilities, youth centers, youth and scouting camps, donations and aids

The entire cost of food, cleaning, clothing and fuel donated to associations and foundations engaged in food banking activities for the purpose of helping the poor

Conservation, restoration and acquisition of works related to culture, art, history, literature, architecture and intangible cultural heritage or promotion of the country, scientific excavations, library, museum, art gallery and cultural center, cinema, theatre, opera, ballet and concert All expenditures and donations and aids related to the construction, repair or modernization of facilities where cultural and artistic activities such as

All sponsorship expenditures for amateur sports, 50% of professional sports branches

All in-kind and cash donations made to presidential aid campaigns

All of the cash donations or aids made to the Red Crescent and Green Crescent

The portion not exceeding 10% of the declared income of the amounts allocated as venture capital funds in accordance with Article 325/A of the Tax Procedure Law

Architecture, engineering, design, software, medical reporting, accounting record keeping, call center, product testing, certification, data storage, given in Turkey to persons not resident in Turkey and those whose workplace, legal and business center is abroad and exclusively used abroad , data processing, data analysis and service enterprises operating in the fields of vocational training determined by the Ministry of Finance by obtaining the opinion of the relevant ministries, and the enterprises operating in the field of education and health subject to the permission and supervision of the relevant ministry and providing services to persons who are not settled in Turkey, are obtained exclusively from these activities. 50% of their earnings

Protected workplace discount at the rate of 100% of the annual gross amount of wage payments made, including the amount paid by other individuals and institutions, for mentally or mentally disabled employees who are employed in sheltered workplaces established in accordance with the Law on Disabled Persons and who are difficult to recruit into the labor market.

The portion of the commercial earnings determined by the simple method up to 8.000 (14,000 TL) Turkish lira per year

50% of the income earned by full taxpayer real persons within the scope of export of goods realized with the electronic commerce customs declaration issued by the Postal Administration authorized as an indirect representative within the scope of Article 225 of the Customs Law or by companies engaged in fast cargo transportation.

Expenses Deducted from Corporate Tax

According to Article 8 of the Corporate Tax Law

Deductible Expenses from Commercial Income

Securities issuance expenses

Establishment and organization expenses

Expenses for general assembly meetings, merger, transfer, division, termination and liquidation expenses

Dividend of the limited partner in limited partnerships whose capital is divided into shares

Dividends paid by participation banks in exchange for participation accounts

Pertaining to insurance contracts in insurance and reinsurance companies; outstanding claims and claims provisions, unearned premium provisions, mathematical provisions in life insurance and balancing provisions

According to Article 40 of the Income Tax Law

General expenses incurred for obtaining and maintaining commercial income,

Subsistence and lodging expenses, treatment and medicine expenses, insurance premiums and retirement dues and clothing expenses as fixtures,

Losses, damages and indemnities paid pursuant to a contract, court order or legal order, provided that they are related to the work,

Travel and residence expenses,

Expenses of vehicles acquired through leasing or included in the business and used in the business,

Taxes, duties and charges in kind such as building, land, expense, consumption, stamp, municipal taxes, fees and records,

Depreciations allocated according to the provisions of the Tax Procedure Law,

Dues paid by employers to unions,

Contributions paid by employers to the private pension system on behalf of wage earners,

The cost of food, cleaning, clothing and fuel donated to associations and foundations engaged in food banking activities with the aim of helping the poor, within the framework of the procedures and principles determined by the Ministry of Treasury and Finance,

Amounts actually paid to beneficiaries of on-the-job training programs organized by the Turkish Employment Agency by the employers running the program.

(*) Due to the reference made in Article 6 of the corporate tax law

Corporate Tax Law Art.9

Loses

According to Article 9 of the Corporate Tax Law, losses incurred due to economic activities carried out in the country and abroad are deducted from the incomes of the following years.

According to Article 10 of the Corporate Tax Law

Other Expenses Subject to Deduction from Corporate Tax

All sponsorship expenditures for amateur sports, 50% of professional sports branches

Up to 5% of the total of donations and aids made to public institutions, local administrations, foundations, associations working for public benefit and institutions and organizations engaged in scientific research and development activities, up to 5% of the corporate income of that year

Expenditures made for the construction of schools, health facilities, student dormitories and kindergartens, orphanages, nursing homes and care and rehabilitation centers, places of worship and non-formal religious education facilities, youth centers, youth and scouting camps, donations and aids

All in-kind and cash donations made to presidential aid campaigns

All of the cash donations or aids made to the Red Crescent and Green Crescent

Conservation, restoration and acquisition of works related to culture, art, history, literature, architecture and intangible cultural heritage or promotion of the country, scientific excavations, library, museum, art gallery and cultural center and cinema, theatre, opera, ballet and concert All expenditures and donations and aids related to the construction, repair or modernization of facilities where cultural and artistic activities such as

The portion not exceeding 10% of the declared income of the amounts allocated as venture capital funds in accordance with the Tax Procedure Law

Protected workplace discount at the rate of 100% of the annual gross amount of wage payments made, including the amount paid by other individuals and institutions, for mentally or mentally disabled employees who are employed in sheltered workplaces established in accordance with the Law on Disabled Persons and who are difficult to recruit into the labor market.

Architecture, engineering, design, software, medical reporting, accounting record keeping, call center, product testing, certification, data storage, given in Turkey to persons not resident in Turkey and those whose workplace, legal and business center is abroad and exclusively used abroad , data processing, data analysis and service enterprises operating in the fields of vocational training determined by the Ministry of Finance by obtaining the opinion of the relevant ministries, and the enterprises operating in the field of education and health subject to the permission and supervision of the relevant ministry and providing services to persons who are not settled in Turkey, are obtained exclusively from these activities. 50% of their earnings

50% of the amount to be calculated over the cash capital increases of the capital companies that increase the cash capital