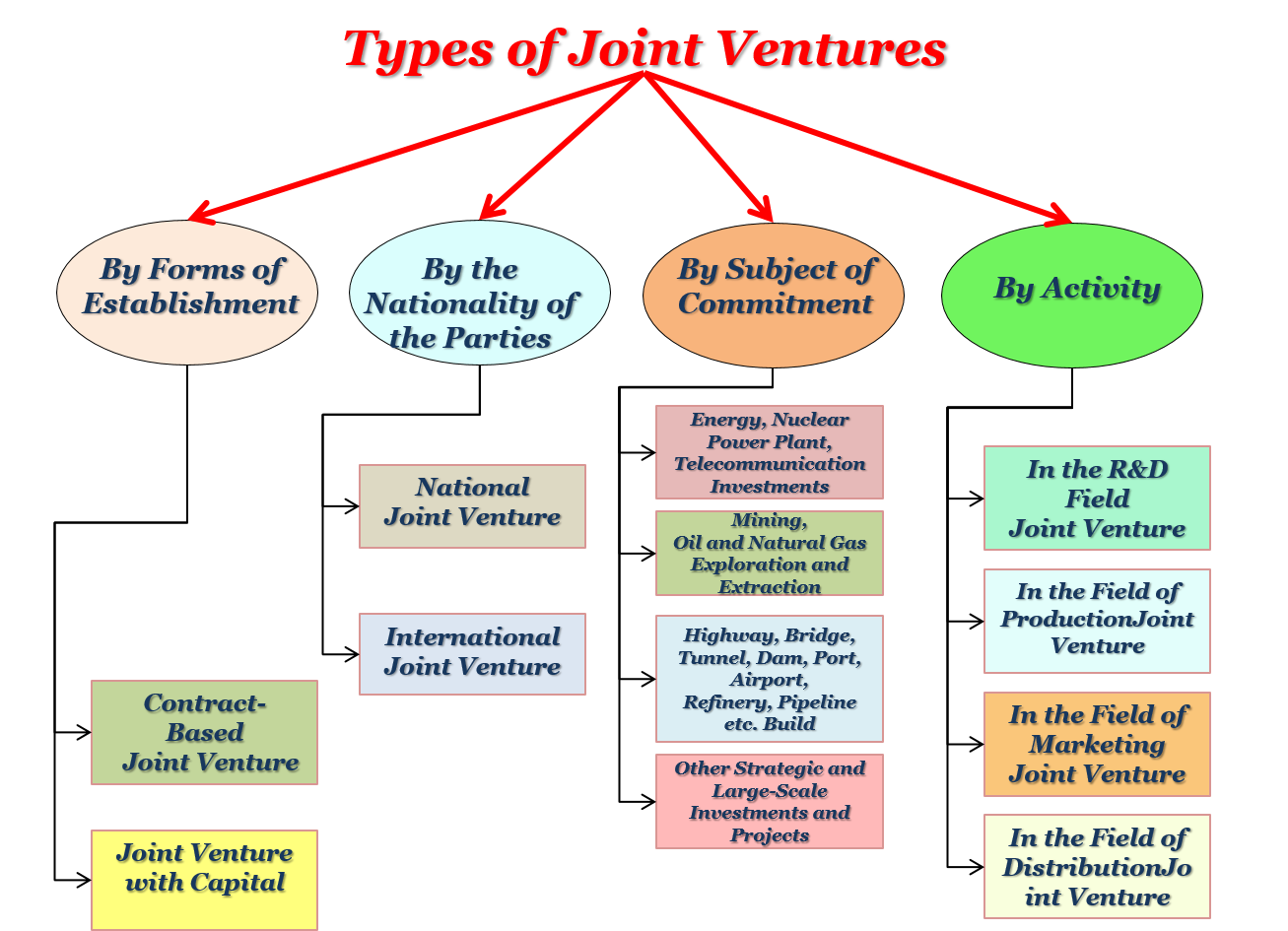

Joint Venture Concept

Joint Venture,

Corporate Tax Law Art.2/7 (Joint Venture): The institutions mentioned in the above paragraphs (capital companies, cooperatives, economic public institutions, economic enterprises belonging to associations and foundations) established among themselves or with sole proprietorships or real persons for the purpose of jointly undertaking a certain business and sharing its profits. Business partnerships are those who demand such liability from partnerships. Their lack of legal personality does not affect their obligations.

Joint Venture,

economically and legally independent of each other

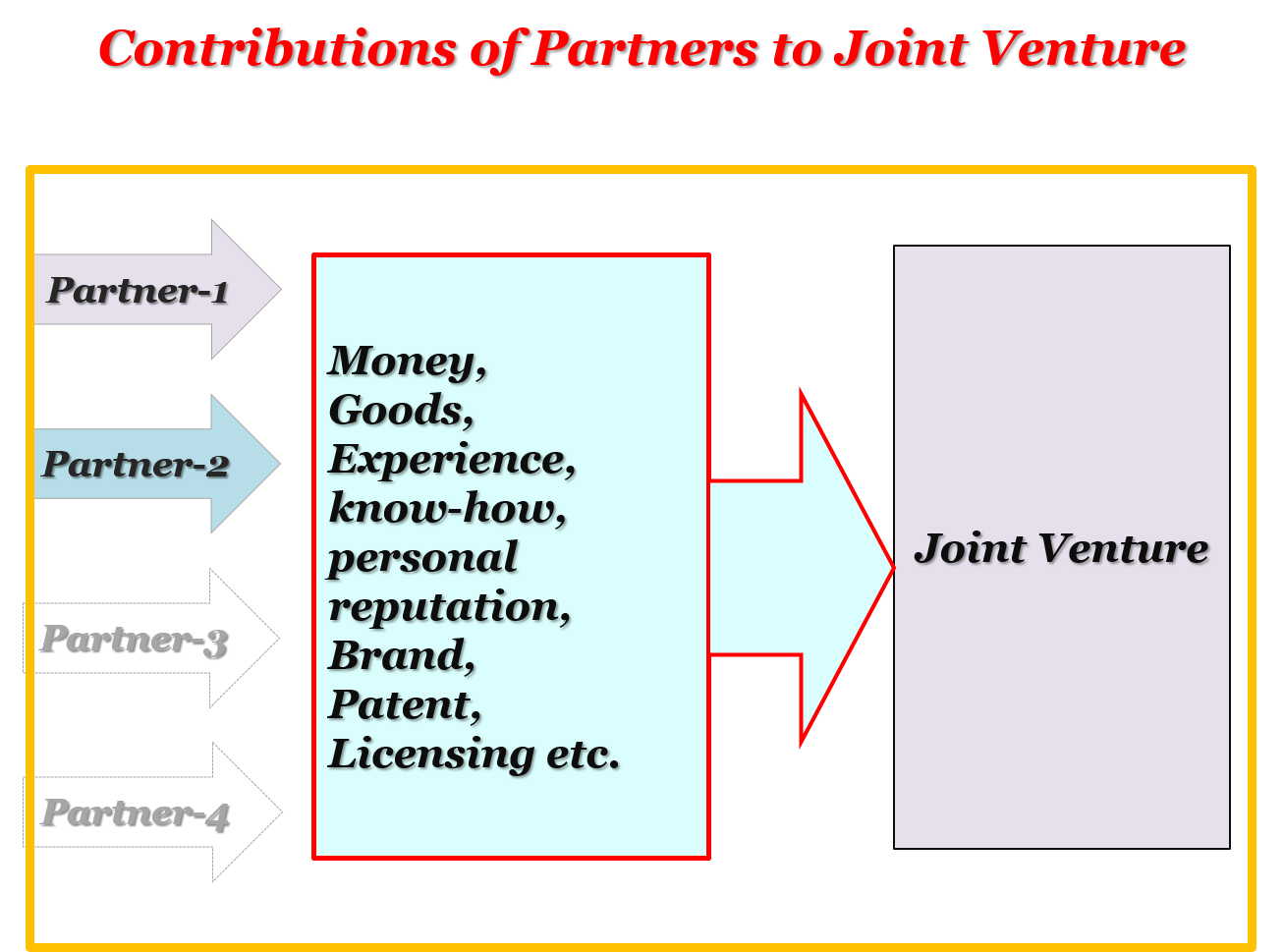

persons or organizations with or without legal personality,

with or without establishing a trading partnership,

jointly undertake to carry out a single business or a continuous activity with the aim of earning a profit; and

It is a contract for which they are jointly and severally responsible for the performance of the work.